Are you new to QuickBooks and looking for a comprehensive guide on expense categories? As a beginner, understanding how to properly categorize your business expenses is crucial for accurate financial tracking and tax compliance.

QuickBooks provides a default list of expense categories, but it’s essential to know how to customize them to suit your unique business needs. In this article, we’ll walk you through the QuickBooks expense categories list, explain why proper categorization matters, and provide tips on tailoring them to your specific industry.

By familiarizing yourself with the QuickBooks expense categories list and tailoring it to your industry, you can streamline your bookkeeping process and gain valuable insights into your business expenses.

Why Proper Expense Categorization Matters

Before diving into the list of QuickBooks expense categories list, let’s discuss why accurate categorization is crucial for your business:

- Financial Clarity: By assigning expenses to the appropriate categories, you gain a clear picture of where your money is going, enabling better cash flow management and financial decision-making.

- Tax Deductions: Properly categorized expenses make it easier to identify and claim tax deductions, potentially reducing your tax liability.

- Budgeting and Forecasting: Accurate expense tracking helps you create realistic budgets and forecast future expenses based on historical data.

- Time-Saving: Consistent categorization streamlines bookkeeping and saves time when preparing financial reports and tax returns.

Default QuickBooks Expense Categories List

QuickBooks offers a default set of expense categories that cover a wide range of business expenses. Below is a detailed table listing all the default expense categories available in QuickBooks:

| Category | Description |

|---|---|

| Advertising/Promotional | Expenses related to promoting your business, such as ads, flyers, and sponsorships |

| Automobile Expenses | Costs associated with business vehicles, including fuel, maintenance, and repairs |

| Legal & Professional Fees | Fees paid to attorneys, accountants, and other professionals for their services |

| Office Supplies & Software | Expenses for office supplies, software subscriptions, and computer equipment |

| Rent & Lease | Costs related to renting or leasing office space, equipment, or vehicles |

| Travel | Expenses incurred during business trips, such as airfare, lodging, and transportation |

| Utilities | Bills for electricity, gas, water, phone, and internet services used for business |

| Payroll Expenses | Salaries, wages, and benefits paid to employees |

| Cost of Goods Sold | Direct costs associated with producing or acquiring the goods your business sells |

| Meals & Entertainment | Expenses for business-related meals, events, and entertainment |

| Bank Charges | Fees charged by banks for account maintenance, overdrafts, and other services |

| Charitable Contributions | Donations made to qualified charitable organizations |

| Dues & Subscriptions | Memberships, subscriptions, and fees paid to professional organizations or services |

| Insurance | Premiums paid for business insurance policies, such as liability and property insurance |

| Interest Paid | Interest paid on business loans, credit cards, and other debts |

| Merchant Account Fees | Fees charged by credit card processing companies for accepting customer payments |

| Taxes & Licenses | Taxes and fees paid to local, state, and federal agencies for business licenses and permits |

These default categories provide a solid foundation for organizing your financial transactions. However, depending on your industry and specific business needs, you may need to create custom categories for a more accurate representation of your expenses.

Customizing Expense Categories for Your Business

While the default categories are helpful, your business may have specific expenses that don’t fit neatly into these pre-defined buckets. QuickBooks allows you to create custom expense categories tailored to your industry and unique needs1.For example:

- Construction companies might add categories like Materials, Equipment Rental, and Subcontractors.

- Restaurants may need categories for Food Costs, Kitchen Supplies, and Linens.

- Retail businesses could track expenses related to Inventory, Packaging, and Shipping.

- Freelancers might want to separate costs for Subscriptions, Home Office, and Outsourcing.

- If your business accepts credit card payments, you may want to create a custom category to Record Credit Card Processing Fees in QuickBooks.

How to Set Up Custom Expense Categories

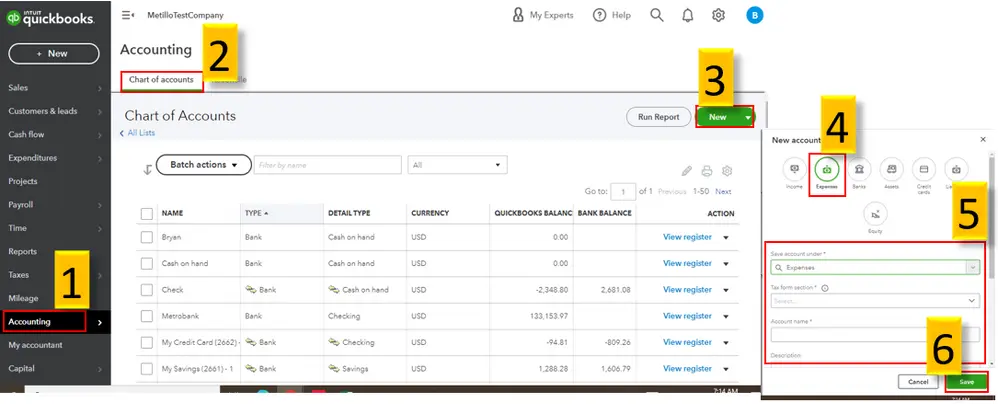

- On your left panel, select Accounting.

- Select Chart of accounts.

- On the right side beside Run Report, click the green colored box with New inside it.

- A new prompt will pop up for a New account, select the Expense icon.

- Fill in the necessary information needed for the expense account scroll down to see more boxes and details to be filled in.

- Once done, click Save.

You can refer the below video for whole process as well:

Best Practices for Managing Expense Categories

To keep your expense tracking organized and efficient, consider implementing these best practices:

- Review categories periodically: Regularly review your expense categories to ensure they still align with your business needs. Remove obsolete categories and add new ones as required.

- Keep it simple: While custom categories are useful, avoid creating too many, as this can lead to confusion and inconsistency. Strike a balance between granularity and simplicity.

- Be consistent: Establish a standard process for categorizing expenses and train your team to follow it consistently. This ensures accurate financial data and saves time in the long run.

- Use sub-categories: For more detailed expense tracking, consider using sub-categories to break down main expense categories into smaller, more specific ones. This can provide deeper insights into your spending habits.

- Leverage automation: QuickBooks offers features like Bank Rules and Receipt Capture, which can help automate expense categorization and save you time.

Conclusion

A well-organized QuickBooks expense categories list is essential for effective financial management and tax preparation. By understanding the default categories, creating custom ones specific to your business, and following best practices, you’ll be well-equipped to master expense tracking in QuickBooks.

Remember, accurate expense categorization provides valuable insights into your business’s financial health, empowering you to make informed decisions and drive growth. Regularly review and optimize your categories to ensure they continue to serve your evolving business needs.

Image sources: Quickbooks